09 Oct Six Ways Agents Fail Their Workers Compensation Clients

855-368-5502

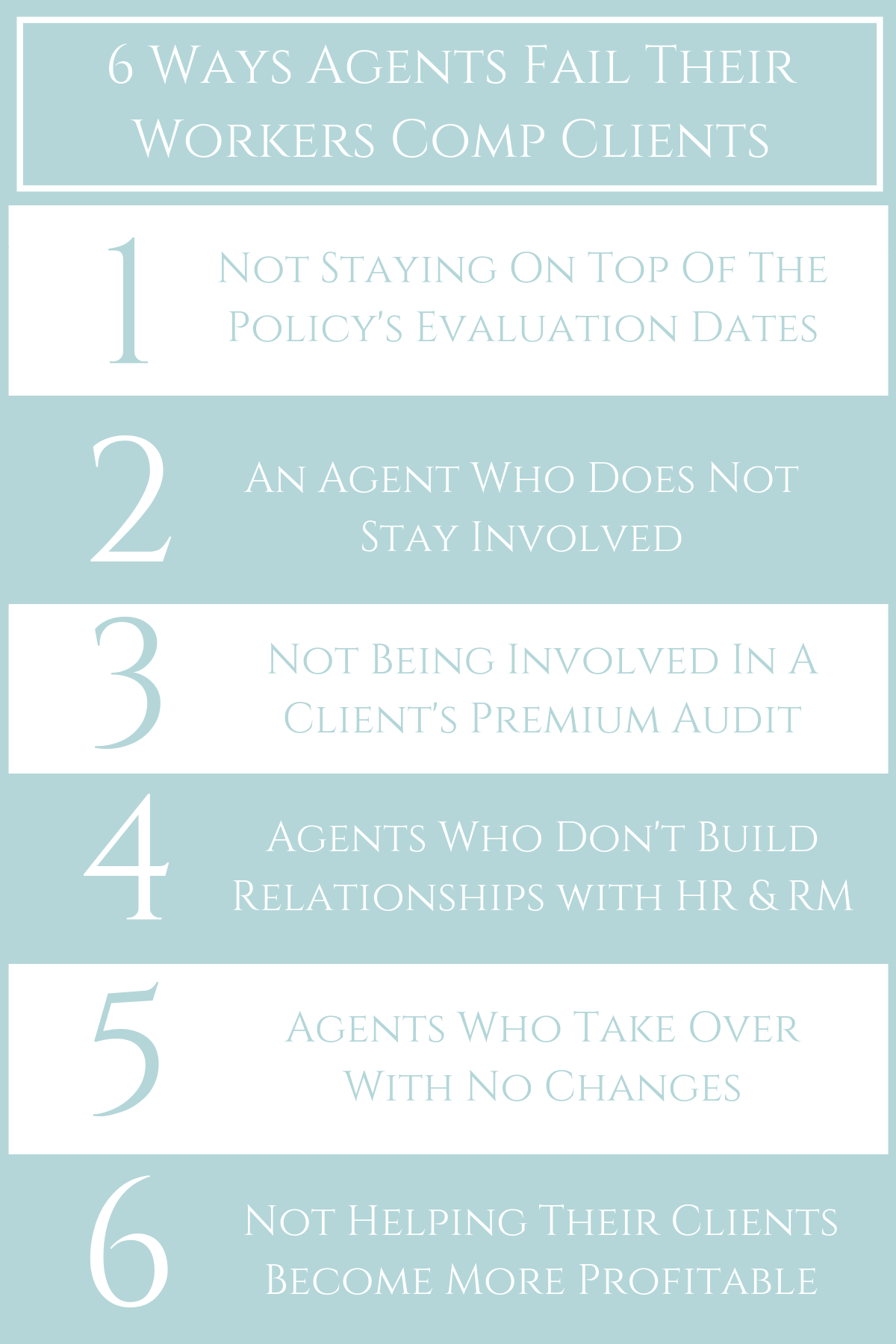

Six Ways Agents Fail Their Workers Compensation Clients

By: Adam Matheny

There are many reasons how insurance agents fail to service their clients’ workers’ comp claims. For some, it is simply a matter of spreading themselves too thin and being unable to perform the necessary follow up care, for others it could simply be a case of complacency. No matter what the reason, failure to provide the necessary care can cost a client vital insurance covered and non-insurance covered monies.

The current Worker’s Comp situation needs a “magic bullet” if it is to survive and continue providing much-needed protection for workers. Among the many challenges faced by insurance providers are an aging workforce who when injured take longer to heal and return to work, the rising cost of drugs, and an insecure workforce that continues to face layoffs in the millions. On top of this, the current softening commercial insurance market has many employers worried about increased exposure.

The list of problems goes on, but the end result is that more carriers are changing the way in which they approach their underwriting and pricing. Along with staying on top of your Worker’s Comp program, you should have a reliable business partner from the outset. Consider these issues.

An Agent Who Doesn't Stay On Top Of The Policy's Evaluation Dates

At the 18-month mark, the insurance company will examine the current status of all claims from when the policy was first written, including those that have been paid and the amount expected to be paid for those still active. Upon examination, it could be that the client has far too much in reserves or perhaps an employee has been cleared to return to work, but the insurance adjuster never got the message. If the agent isn’t on the ball, the client could end up overpaying for the next year.

An Agent Who Does Not Stay Involved

Most employers will call their agent the moment an employee is injured. Not only is timely reporting required, but it helps speed up the process of having the checks cut. A good agent stays on top of every aspect of the injury, the care given, and all communications between the injured employee, the employer, the adjuster, and the medical personnel. The smoother the communications between all parties go, the less exposure the client is likely to have to worry about.

Agents Who Fail to Become Involved in a Client's Premium Audit

If an agent fails to get involved in their client’s premium audit from the outset, problems can arise when an unexpected bill shows up in the mail. It is vital that the agent be proactive in making sure everything is accurately reported at the time of the audit.

Agents Who Don't Build a Positive Relationship with HR and RM Personnel

Agents need to build a healthy relationship with the HR (Human Resources) and RM (Risk Management) departments of the companies they represent. In today’s economy, these departments are understaffed and overworked. Most do not have the training needed to handle claims properly. Be sure the agent hired has the skill and knowledge to get the job done right.

Agents Who Take Over with No Changes

Imagine a baseball team that has been losing hires a new manager. But, when he takes over, he makes no changes to the lineup. With no changes the team continues to lose games. This is exactly what happens when a new commercial insurance agent takes over an existing account and does nothing to look over the classifications used by the outgoing agent. When this happens, the agent is doing the client a great disservice as a thorough review could yield changes that could save the client money.

Agents Who Are Not Helping Their Clients to Become More Profitable

One of the most important rules of business is that it is more important to make money than it is to save it. A top-quality agent will work hard to teach their clients the difference between saving money in the short run by purchasing “cheap” Worker’s Comp insurance and spending a little more now to provide for better coverage and protection in the future. This is the type of agent who will work hard to aggressively manage claims and provide the resource and tools needed to protect their client’s interests.

Partner With The Best

Flow Insurance Services knows workers compensation insurance, and we know it well. Place your trust in us and let us help you to write more business. When it comes to growing your business, things can be challenging. Embrace the opportunity of workers compensation insurance!